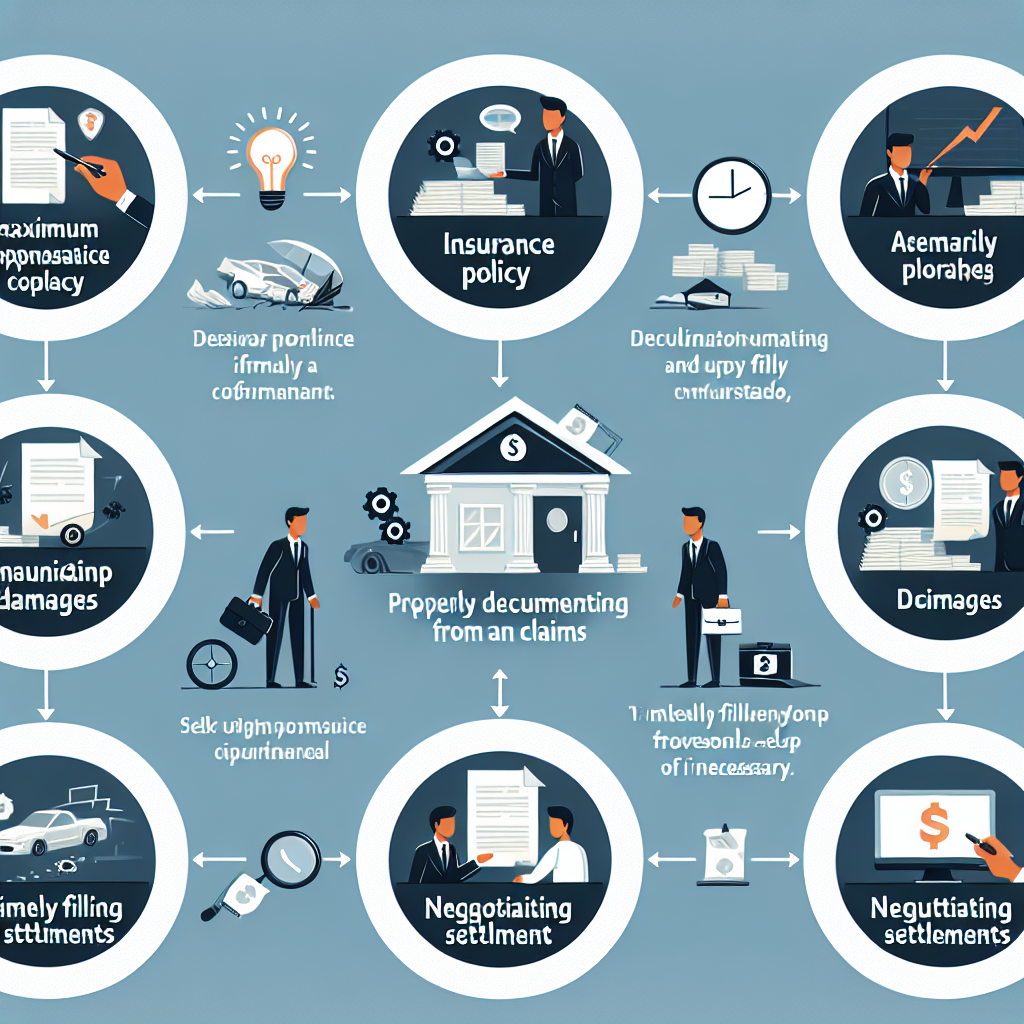

Understanding Your Insurance Policy: The first step to getting maximum compensation from your insurance company is to thoroughly understand your insurance policy. This includes knowing what is covered, what is excluded, and any limits or deductibles that may apply. By having a clear understanding of your policy, you can ensure that you are not missing out on any potential compensation

Insurance is a necessary aspect of our lives, providing us with financial protection in case of unexpected events. However, when it comes to making a claim, many people are left feeling frustrated and confused. They may not receive the compensation they were expecting or may face delays in the process. This is why it is crucial to understand your insurance policy and how to get maximum compensation from your insurance company.

The first step to getting maximum compensation is to thoroughly understand your insurance policy. This may seem like a daunting task, but it is essential to know what you are covered for and what you are not. Your policy is a legal contract between you and the insurance company, and it outlines the terms and conditions of your coverage. It is crucial to read and understand your policy before signing it, as it will determine the compensation you receive in the event of a claim.

One of the most critical aspects of your insurance policy is knowing what is covered. This includes understanding the types of events or risks that are covered, such as natural disasters, accidents, or theft. It is also essential to know the extent of coverage for each event. For example, if your policy covers natural disasters, does it include floods, earthquakes, or hurricanes? Knowing the specifics of your coverage will help you determine if you are eligible for compensation in a particular situation.

On the other hand, it is equally important to know what is excluded from your policy. Insurance policies often have exclusions, which are events or risks that are not covered. These exclusions can vary from policy to policy, so it is crucial to read them carefully. For example, your policy may exclude coverage for pre-existing conditions or certain types of accidents. By knowing what is excluded, you can avoid any surprises when making a claim and ensure that you are not missing out on any potential compensation.

Another crucial aspect of understanding your insurance policy is knowing the limits and deductibles that may apply. Limits refer to the maximum amount of compensation you can receive for a particular event or risk. For example, if your policy has a limit of $10,000 for property damage, you will not receive more than that amount, even if the damage exceeds it. Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage kicks in. Knowing the limits and deductibles of your policy will help you manage your expectations and avoid any surprises when making a claim.

Once you have a clear understanding of your insurance policy, you can take steps to ensure that you get maximum compensation from your insurance company. The first step is to document everything related to the event or risk that you are claiming for. This includes taking photos, videos, and written statements from witnesses. The more evidence you have, the stronger your case will be, and the more likely you are to receive the compensation you deserve.

It is also crucial to report the incident to your insurance company as soon as possible. Most policies have a time limit for reporting claims, and if you miss it, you may not be eligible for compensation. When reporting the claim, be sure to provide all the necessary information and evidence to support your case. This will help expedite the process and increase your chances of getting maximum compensation.

In conclusion, understanding your insurance policy is the key to getting maximum compensation from your insurance company. By knowing what is covered, what is excluded, and any limits or deductibles that may apply, you can avoid any surprises and ensure that you receive the compensation you deserve. Remember to document everything and report the claim promptly to increase your chances of a successful outcome. With these tips in mind, you can navigate the claims process with confidence and get the maximum compensation from your insurance company.

Documenting Damages: When filing a claim with your insurance company, it is important to provide thorough documentation of any damages. This can include photos, videos, and written descriptions of the damage. The more evidence you have, the stronger your case will be for maximum compensation. It is also important to document any expenses related to the damages, such as repair costs or medical bills

When disaster strikes, whether it be a natural disaster or an accident, it can be a stressful and overwhelming experience. In these situations, having insurance can provide some relief and financial support. However, getting the maximum compensation from your insurance company may not always be a straightforward process. Insurance companies are businesses, and their main goal is to minimize their payouts. This is why it is crucial to know how to document damages and expenses properly when filing a claim.

The first step in documenting damages is to gather evidence. This can include taking photos or videos of the damage, as well as writing a detailed description of what occurred. It is important to do this as soon as possible after the incident, as the damage may worsen over time. These pieces of evidence will serve as proof of the extent of the damage and can help support your claim for maximum compensation.

When taking photos or videos, make sure to capture the damage from different angles and distances. This will provide a comprehensive view of the damage and leave no room for doubt. Additionally, if there are any items that have been damaged, such as furniture or appliances, make sure to include them in the photos or videos. This will help determine the value of the items and the extent of the damage.

In addition to visual evidence, it is also important to provide a written description of the damage. This should include details such as the date and time of the incident, the cause of the damage, and any other relevant information. Be as specific as possible and avoid using vague terms. For example, instead of saying “the roof was damaged,” specify the type of damage, such as “the roof was punctured by a fallen tree branch.” This will help paint a clear picture for the insurance company and strengthen your case for maximum compensation.

Apart from documenting the damage itself, it is also crucial to keep track of any expenses related to the damage. This can include repair costs, medical bills, and any other out-of-pocket expenses. Make sure to keep all receipts and invoices as proof of these expenses. If possible, get multiple quotes for repair costs to show the insurance company that you are not overestimating the expenses.

When documenting expenses, it is important to be organized and keep all documents in one place. This will make it easier to present them to the insurance company and avoid any confusion or missing information. It is also helpful to keep a record of any communication with the insurance company, including emails and phone calls. This will serve as evidence of your efforts to resolve the claim and can be used to support your case for maximum compensation.

In some cases, the insurance company may send an adjuster to assess the damage. It is important to be present during this assessment and provide them with all the evidence and documentation you have gathered. Be cooperative and answer any questions they may have. However, if you feel that the adjuster is not accurately assessing the damage, do not hesitate to get a second opinion from a professional.

In conclusion, documenting damages and expenses is crucial when filing a claim with your insurance company. It is important to gather as much evidence as possible, including photos, videos, and written descriptions. Keep all documents organized and be prepared to present them to the insurance company. By following these steps, you can strengthen your case for maximum compensation and ensure that you receive the support you need during a difficult time.

Negotiating with Your Insurance Company: In some cases, insurance companies may offer a lower settlement than what you believe you are entitled to. It is important to negotiate with your insurance company to ensure that you receive the maximum compensation for your claim. This may involve providing additional evidence or seeking legal assistance. It is important to be persistent and advocate for yourself to get the compensation you deserve

When it comes to filing an insurance claim, the ultimate goal is to receive the maximum compensation for your losses. However, in some cases, insurance companies may offer a lower settlement than what you believe you are entitled to. This can be frustrating and overwhelming, but it is important to remember that you have the right to negotiate with your insurance company to ensure that you receive the compensation you deserve.

The first step in negotiating with your insurance company is to thoroughly review your policy and understand your coverage. This will help you determine what you are entitled to and what your insurance company is responsible for covering. It is also important to gather all necessary documentation and evidence to support your claim. This may include photos, receipts, and any other relevant information.

Once you have a clear understanding of your policy and have gathered all necessary evidence, it is time to approach your insurance company. It is important to remain calm and professional during this process. Remember, the person you are speaking with is simply doing their job and may not have the authority to make decisions on your claim. Be polite but firm in your request for maximum compensation.

If your initial negotiation with your insurance company does not result in a satisfactory outcome, do not be discouraged. It is important to be persistent and continue advocating for yourself. This may involve providing additional evidence or seeking legal assistance.

If you feel that your insurance company is not offering a fair settlement, it may be necessary to seek legal representation. An experienced attorney can help you navigate the negotiation process and ensure that your rights are protected. They can also provide valuable insight and advice on the best course of action for your specific situation.

When negotiating with your insurance company, it is important to keep in mind that they are a business and their main goal is to minimize their costs. This means that they may try to offer a lower settlement in hopes that you will accept it and they can close the claim quickly. However, it is important to remember that you have the right to receive the maximum compensation for your losses.

During the negotiation process, it is important to remain organized and keep detailed records of all communication with your insurance company. This includes phone calls, emails, and any written correspondence. This will help you keep track of any promises or agreements made and can be used as evidence if necessary.

It is also important to be aware of any deadlines or time limits for filing a claim or appealing a decision. Missing these deadlines can result in your claim being denied or your ability to negotiate being limited. Stay on top of these deadlines and seek legal assistance if needed to ensure that you do not miss any important dates.

In conclusion, negotiating with your insurance company is an important step in receiving the maximum compensation for your claim. It is important to thoroughly review your policy, gather all necessary evidence, and remain persistent and organized during the negotiation process. If necessary, seek legal assistance to ensure that your rights are protected and you receive the compensation you deserve. Remember, you have the right to advocate for yourself and your losses.